The best credit cards for greedy software founders

Ian Landsman • July 5, 2019

This article is about greed. Greed in maximizing the rewards we get by the fact that as software founders, we pay for nearly everything with a credit card.

As Gordon Gekko once said:

The point is, ladies and gentlemen, that greed, for lack of a better word, is good. Greed is right. Greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms, greed for life, for money, for love, for credit card reward points.

I've done a lot of research in this area and utilized points to fly my entire family to Europe for free, upgrade flights to first class, and buy widgets on Amazon (not a great use TBH).

How to use "Business" credit card rewards

Let's get one thing straight right now. You should not ever use your reward points on things you can expense in your business.

The reward points your business generates should strictly be for personal gain. All the banks allow you to transfer or merge your points with a personal account. I'm also fine with directly spending the points out of the business accounts. If you're an S-Corp or LLC there's no problem with doing so as they roll up to you in any case.

Using your reward points for items your business could otherwise expense doesn't make any sense. Take the write-off, keep the points.

Another side note is some of the cards have significantly better benefits than your personal cards are likely to have.

Discounted tickets, a 3x point bonus on a hotel stay, etc.

In a case where I can benefit by using the business card I will do so. You can then simply account for the cost as an owner draw from the business just as if you took cash out of it.

Tax consequences

I can hear you right now. Ian, this is great but you're going to get me thrown in jail!

Well the good news is that the IRS has almost no auditors anymore 😃.

OK OK, I have actual good news. The IRS has issued a ruling that points acquired on a business basis, but used personally have no tax consequences. Booyah!

In theory, if you used the points for business expenses, you are supposed to track the discounted amount and apply tax to that. However, as doing so is extremely hard to track this isn't done in practice. Regardless, it only makes the case stronger for using your business points for personal gain.

** What credit cards do I recommend? **

Let's get to the juicy bits. After much consideration, these are the cards I use to run my business. There are many others and The Points Guy is a good resource for exploring those. I think the ones below though will generally be the best bet for most software businesses.

FYI the links below include a referral link. If you choose to go with one of these using the link will kick me some points which would make my day!

Chase Ink Business Preferred

Sign up here and I'll get a few bonus points (thanks!).

This is my go-to credit card. Chase points are worth roughly 2 cents per point and this card gives you 3x points per $1 spent on many transactions software companies make.

This card usually has an 80,000 point sign up bonus (worth $1,600) and only has a $95/year fee. Making this credit card a value monster.

3 of the 4 primary 3x categories are huge for us:

- Travel expenses (airline tickets, hotels, etc)

- Social media advertising (Facebook, Twitter, etc)

- Internet, Cable, and Phone

The real key here is the "internet", cable and phone. First off, we're all paying $150/month for our phones so pop that on there as well as your cable internet.

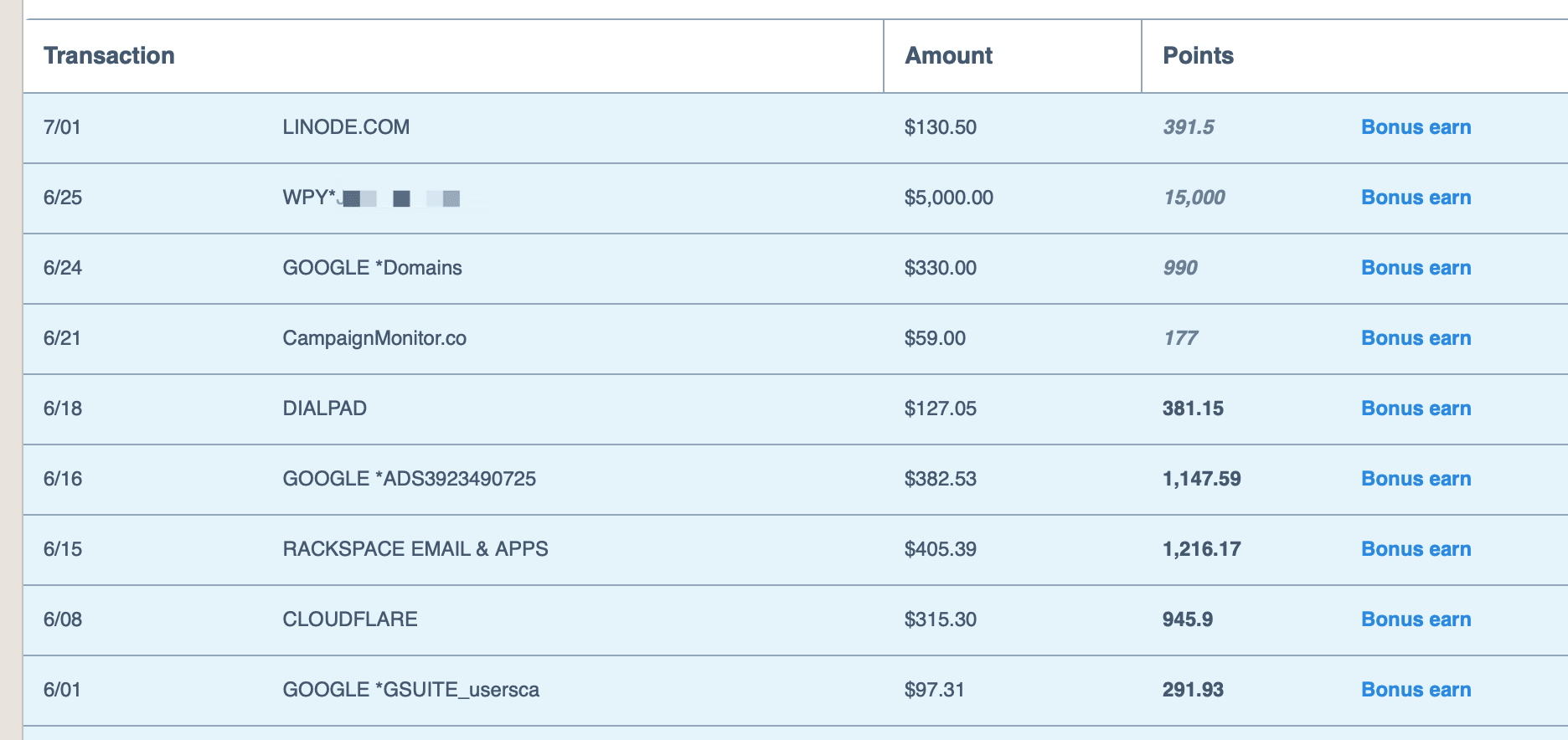

However, the "internet" category covers a lot of internet services we all use. Here's a sample of mine. Here are the transactions that were 3x last month for me. 20,500 points in total which is about $410 in points. Enough for a comfort class round trip ticket to Vegas baby 🎲.

Warning, these do change from time to time as they're based 100% on the transaction type coding the business uses. For example, one that hurt recently is our $4,000/month AWS bill stopped being a 3x bonus due to the recording of its transactions changing (more on how I adjusted for this below).

The other nice benefit of this card is that when you book travel through the Chase travel portal your points are worth 25% more. So that's a significant discount on hotel rooms.

Remember, only book personal travel(!) and account for it as an owner draw. Do book business travel on this card though to receive the 3x bonus points on your money.

American Express Blue Business Plus

Sign up here and I'll get a few bonus points (thanks!).

American Express points are worth roughly 2 cents per point and this card gives you 2x points per $1 spent on your first $50,000 you spend each year. No annual fee.

What's great about this card is there are no special categories. You get 2x points on everything. So I'll put everything that doesn't register as 3x on Chase onto this card.

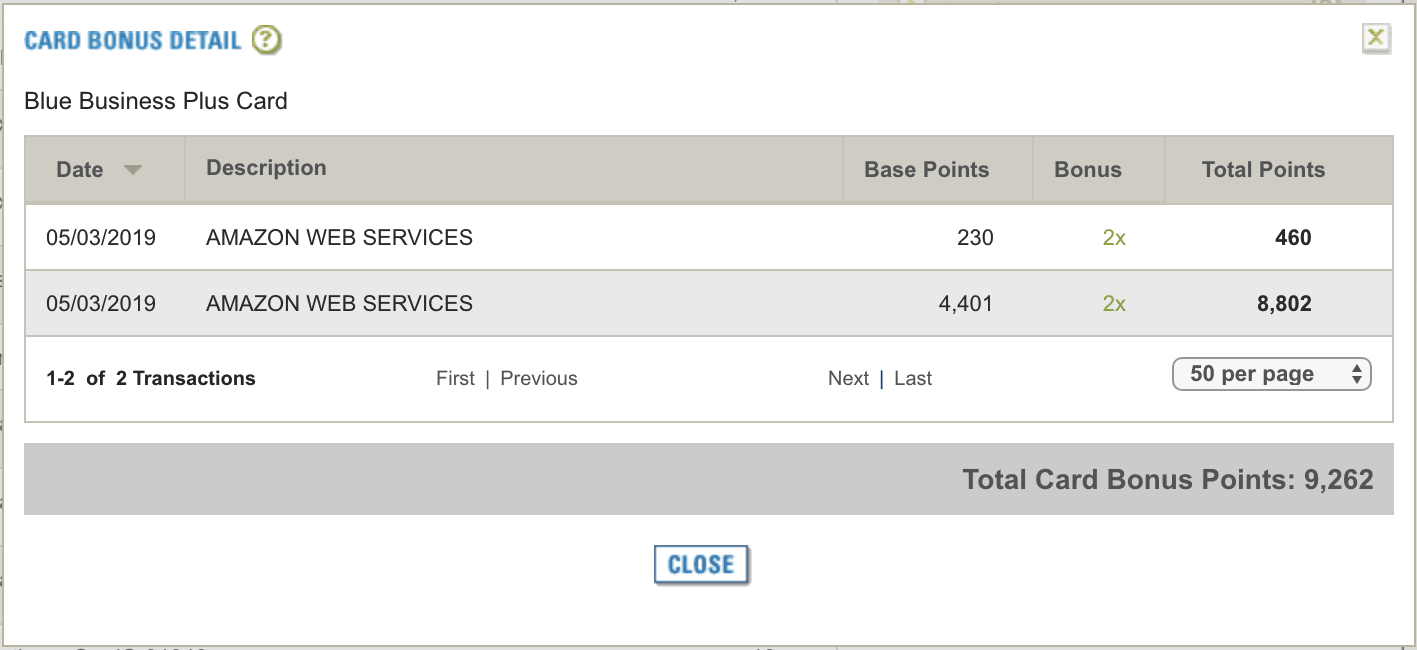

Since AWS is no longer 3x on Chase I've moved all that over to here which eats up pretty much the entire $50,000 limit 😞 but it's still 1x points beyond that.

American Express points are great because they tend to be the most flexible with the most transfer partners of any reward program. They're the real bread and butter of a good rewards plan.

In addition, as these points pool with your other Amex cards the points earned here are even more valuable when paired with an Amex Business Platinum card due to the rewards that card offers such as the 35% points back program on certain airlines/airfares.

American Express Business Platinum

Sign up here and I'll get a few bonus points (thanks!).

The granddaddy of rewards cards. The $595 annual fee and more unique reward structure make this card one you have to think about more carefully. However, if you value what it provides it can be worth having.

Most purchases are only 1x points with this card. So you won't want to use it for hosting costs, SaaS apps, or other such standard transactions.

Purchases over $5,000 are 1.5x points which is ok, but one of the other two cards above is likely better in most cases.

The Platinum card really shines with travel. First, most flights and hotels are 5x points as long as you book through the Amex travel portal. You'll want to shop around when you do this as I have sometimes seen it have worse pricing that alternative sites.

If you regularly fly one airline the Platinum card has a great bonus where if you pay for a flight with points you'll receive 35% of those points back, making it 35% cheaper to fly.

The 35% kickback also applies to business class or better flights on any airline. Sometimes that can bring your costs for such tickets down to less than a non-business class flight.

I used this with my family of 5 when flying home from Rome to New York with Norwegian who's not exactly business class business class qualifies.

Access to Fine Resorts & Hotels is another bonus. These are properties that Amex has worked out a special arrangement with. When booking with them through the Amex travel portal you'll receive 5x points plus some significant bonuses:

- Free room upgrade (which are usually very nice at these sort of properties)

- Breakfast for two

- Early checkin, late checkout

- Free wifi

- and a bonus, which is usually a $100 credit to the spa or similar.

While this applies to elite expensive properties I've seen it applied to some less expensive hotels as well. It also always applies so if you catch a top tier hotel at an off-peak time you'll still get all the perks at a much lower rate.

There are also many other small rewards with the card that can really add up if you travel enough to take advantage of them:

- Automatic Hilton Gold status and Marriott Gold Elite status allowing you to receive upgraded rooms, free internet, etc.

- $200 in airline credits per year

- Access to 1200 airport lounges including exclusive access to Centurion lounges.

So is it worth it? The Chase and Blue cards above are no brainers, 100% must have for any software founder. The Amex Business Platinum is much more case dependent. If you ever use any of the flight and hotel benefits it almost surely pays for itself even with the $595 annual fee. It also gives you access to better experiences which is valuable even if you fall short of covering the fee in savings.

A few parting tips

The dollar value of points stated above are generally based on utilizing points for travel. This is almost always the best use of points. Connecting it to your Amazon account and buying golf balls with it or redeeming them for gift cards is almost always losing 50% or more of the value.

Unless your business has a very large amount of spend each month you'll probably want to stagger adding these. Especially if you're interested the Platinum card as it has a pretty high initial spend to get the sign up bonus. You want the sign up bonus!

Finally, we've found that being more diligent about point acquisition and usage has been a real boon to our family. It's motivated us to take trips we otherwise would not have taken and allowed us to maximize the value of our business expenses.

The point is, ladies and gentlemen, that greed, for lack of a better word, is good!